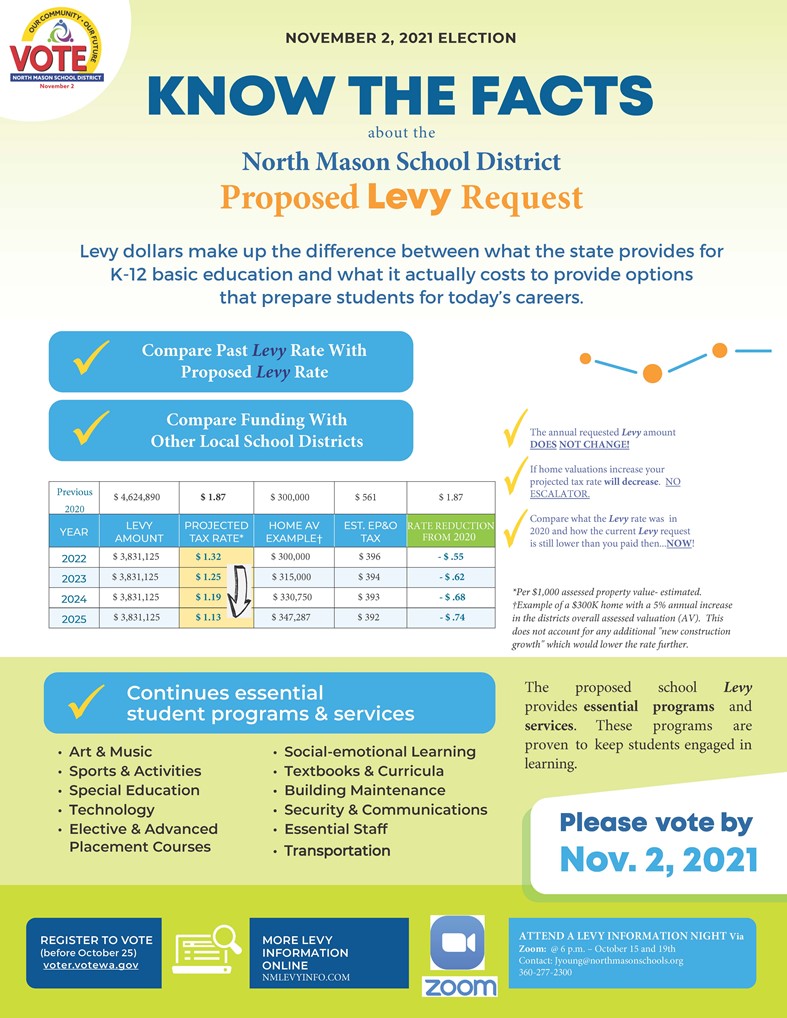

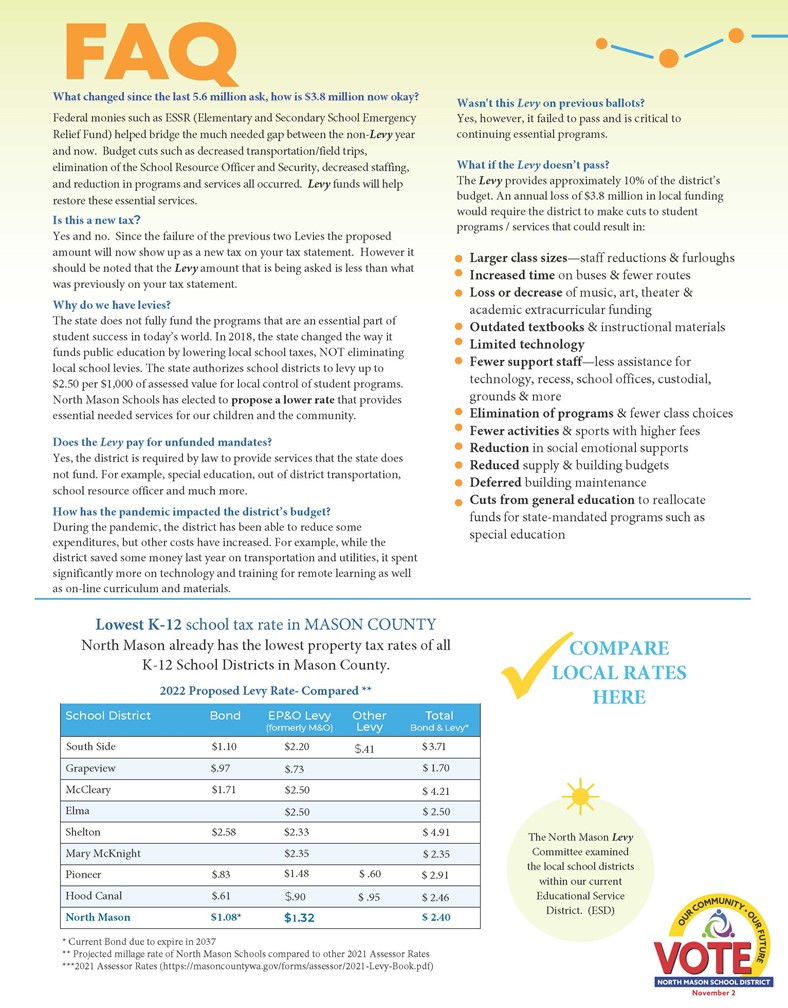

At the school board meeting in July, the NMSD school board took action to update the ballot language on it’s previously approved levy election request for the November ballot. Many community members saw an increase in their property value tax assessment in June. The board had approved a request for a $3.8 million levy with an estimated $1.50/ $1,000.00 rate based on previous property value assessments. In order to provide the most accurate possible information to our voters, the community based levy recommended the district consider recalculating this estimate. We developed a new estimate of $1.32/$1,000.00 and the board voted to approve this updated language. It is a conservative estimate and the actual assessment could be considerably lower once the levy is approved. This is a very conservative levy request overall and far below the $2.50/$1,000.00 cap. This is also considerably lower than the total request in 2019. We are proud of our efforts to be careful stewards of our taxpayers dollars in meeting the needs of our students.